Reliable & Cost-Effective Shipping from China

Tailored Logistics Solutions for Your Business

DDP vs CIF vs FOB: Which Is Best for Your Business in 2025?

- L. Liu

In the evolving world of international trade, understanding critical Incoterms is essential for optimizing freight costs, shipping processes, and managing customs clearance effectively. Among the most discussed Incoterms in 2025 are DDP (Delivered Duty Paid), CIF (Cost, Insurance, and Freight), and FOB (Free on Board). These terms often involve various additional fees such as customs charges, docking fees, and other costs that arise at the destination port, emphasizing the financial responsibilities that the buyer must assume once the goods are loaded onto the shipping vessel.

These trade terms define risk allocation, responsibility transfers, and transportation costs between buyer and seller. Selecting the right Incoterm can dramatically impact your global trade strategy, international logistics, and overall supply chain performance.

Key Responsibilities of CIF and FOB Agreements

Under a CIF agreement, the seller is accountable for the costs and transport of goods until delivery, while the buyer assumes responsibility once the goods are loaded onto the shipping vessel, including any additional costs at the destination.

By comparison, a FOB agreement allows the seller to be responsible for costs and risks until the goods are loaded onto the shipping vessel. At that point, the buyer assumes liability, offering greater flexibility and cost-effectiveness for buyers by enabling them to negotiate shipping terms.

This guide will explain the key differences between DDP vs CIF vs FOB, helping you make informed decisions that reduce shipping costs, improve logistics efficiency, and protect your business during international transactions.

Introduction to Incoterms

Incoterms, or International Commercial Terms, are a set of standardized rules established by the International Chamber of Commerce (ICC) to define the responsibilities of buyers and sellers in international trade transactions. These terms are crucial for simplifying the shipping process by clearly outlining who handles key aspects such as transportation, insurance, customs clearance, and associated costs. Understanding Incoterms is essential for businesses engaged in international trade to optimize their logistics processes and bottom line. Key terms like Delivered Duty Paid (DDP), Cost Insurance and Freight (CIF), and Free on Board (FOB) are fundamental in navigating the complexities of international shipping and ensuring smooth transactions.

What is DDP (Delivered Duty Paid)?

DDP (Delivered Duty Paid) is the most buyer-friendly term, where the seller assumes full responsibility for the entire shipping process, including customs duties, import customs clearance, taxes, and final delivery to the buyer’s premises. This includes the seller’s responsibilities such as handling proof of delivery, managing shipping costs, and ensuring compliance with government regulations and documentation. The buyer bears no responsibility until the goods arrive at the final destination.

Key Features of DDP

Seller covers all costs, including international shipping, customs fees, insurance costs, delivery duty paid services, and export duties.

Buyer assumes no risk until goods are received.

Suitable for companies preferring hassle-free shipping operations.

Pros and Cons of DDP

Pros | Cons |

|---|---|

Seller responsible for the entire shipping process | Higher associated costs and potential extra costs for the seller |

No customs clearance or import duties for buyer | Seller must manage export and import requirements in the destination country |

Simple and predictable freight costs | Requires seller knowledge of international trade laws |

What is CIF (Cost, Insurance, and Freight)?

CIF contract places more responsibility on the seller up to the destination port, including shipping costs, insurance coverage, and export customs clearance. After the goods arrive at the port, the buyer assumes responsibility, including import customs clearance, customs fees, and final delivery.

Key Features of CIF

Seller covers the entire shipping process to the destination port, including cost insurance and freight.

Buyer bears responsibility from the port, including all local handling and taxes.

Popular for buyers who can manage customs clearance and local deliveries.

CIF agreements are a preferred shipping option for international transactions, simplifying the shipping process for buyers who may lack logistical expertise, though at a higher cost.

Pros and Cons of CIF

Pros | Cons |

|---|---|

Seller assumes shipping and insurance up to port | Buyer pays for all costs, including transport costs, after arrival at destination port |

Reduces buyer’s involvement in international shipping process | Less control over shipping operations and potential hidden costs |

Insurance paid by seller until arrival | Buyer must handle import customs clearance |

What is FOB (Free on Board)?

FOB is a classic term in international trade transactions, especially for sea freight. Under FOB, or fob origin, the seller’s responsibility ends once the goods are loaded onto the vessel at the port of loading. The buyer assumes full responsibility from that point, including insurance coverage, freight costs, customs clearance, and final delivery.

Key Features of FOB

Buyer assumes responsibility from loading port.

Seller pays for export customs clearance and inland transportation to the port.

Seller delivers goods to the nearest port for proper logistics and customs clearance.

Ideal for experienced importers working with a reliable freight forwarder.

Pros and Cons of FOB

Pros | Cons |

|---|---|

Full control over shipping company, insurance coverage, and the ability to work with freight forwarders to manage shipping responsibilities | Buyer assumes all risks after loading |

Transparency in shipping costs | Requires buyer to manage customs formalities and final delivery |

Lower seller’s responsibility | Buyer needs knowledge of international logistics |

Buyer’s Responsibility

The buyer’s responsibility in international trade varies significantly depending on the Incoterm used. For example, under FOB (Free on Board), the buyer assumes responsibility for the goods once they are loaded onto the ship at the port of origin. This includes managing insurance coverage, freight costs, customs clearance, and final delivery. In contrast, under DDP (Delivered Duty Paid), the buyer’s responsibility is limited to unloading the goods at the final destination, as the seller handles all other aspects of the shipping process. Understanding these key differences is essential for buyers to avoid unexpected costs and delays. By being aware of their responsibilities, buyers can make informed decisions and negotiate terms that best suit their needs.

Seller’s Responsibility

The seller’s responsibility in international trade also varies depending on the Incoterm used. Under FOB (Free on Board), the seller is responsible for handling export clearance, providing all necessary documentation, and paying any charges associated with loading the goods aboard the ship. Conversely, under DDP (Delivered Duty Paid), the seller bears the majority of responsibility, including managing both export and import customs clearance, paying all duties and taxes, and covering transportation expenses from origin to final destination. Sellers must be aware of their responsibilities to ensure compliance with international trade laws and regulations, thereby avoiding potential legal issues and ensuring smooth transactions.

Working with Chinese Suppliers

When working with Chinese suppliers, it is essential to understand the Incoterms used in the shipping process. Chinese suppliers often prefer to use FOB (Free on Board) or EXW (Ex Works), which can leave the buyer with significant responsibilities, including export and import clearances, freight costs, and insurance paid. Buyers should negotiate with suppliers to use Incoterms that better suit their needs, such as DDP (Delivered Duty Paid), which can provide more control over the shipping process. Understanding the costs associated with each Incoterm, including shipping costs, customs fees, and insurance costs, can help buyers make informed decisions when working with Chinese suppliers, ensuring a smoother and more cost-effective transaction.

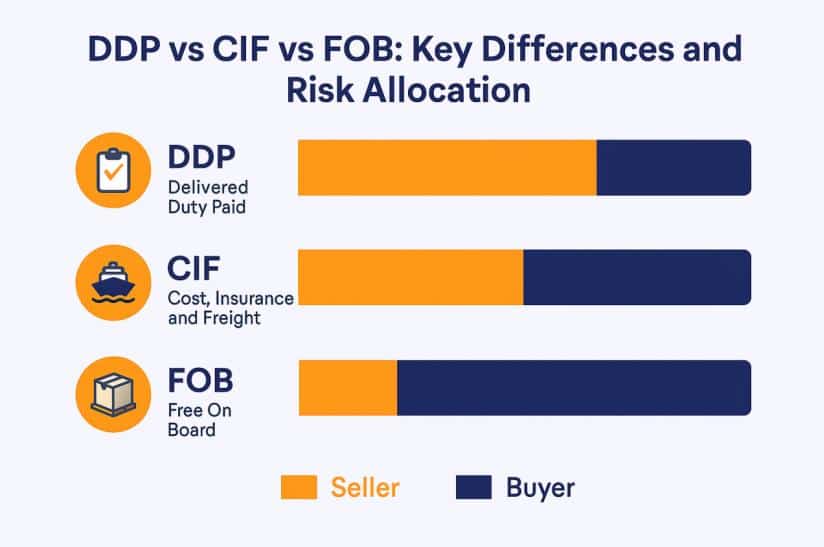

DDP vs CIF vs FOB: Key Differences and Risk Allocation

Factor | DDP | CIF | FOB |

|---|---|---|---|

Seller’s Responsibility Ends | At buyer’s premises (seller transfers all risks and costs) | At destination port (seller transfers responsibility upon arrival) | At loading port (seller transfers responsibility once loaded) |

Insurance Paid By | Seller (entire route) | Seller (up to port) | Buyer |

Customs Clearance | Seller | Buyer | Buyer |

Risk Transfer Point | At final delivery | At destination port | Once goods are loaded |

Best For | Buyers preferring delivered duty paid services | Buyers preferring cost insurance and freight agreements | Experienced buyers managing freight forwarder arrangements |

Learn more:

What Does CPT Term Mean in Shipping? (2025 Guide)

Documents Required to Import from China (2025 Guide)

Delivered Duty Unpaid (DDU): What It Is and How It Works (2025 Guide)

EXW (Ex Works) Incoterms 2025: Essential Guide and Updates

FCA Incoterms 2025 Guide: Meaning, Shipping Terms, and Responsibilities

Incoterms for All Transportation Modes

Incoterms can be categorized into two main groups: those that apply to all modes of transportation and those that cater only to sea and inland waterway transport. Incoterms like EXW (Ex Works), FOB (Free on Board), and FCA (Free Carrier) can be used for all transportation modes, providing flexibility for businesses engaged in various types of shipping. On the other hand, Incoterms like FAS (Free Alongside Ship), CFR (Cost and Freight), CPT (Carriage Paid To), CIP (Carriage and Insurance Paid To), and DAP (Delivered at Place) are specific to sea and inland waterway transport. Understanding the different Incoterms and their applications can help businesses navigate the complexities of international logistics and ensure compliance with international trade laws and regulations. By using the right Incoterm, businesses can minimize the risk of misunderstandings and disputes, ensuring a smooth shipping process from the port of origin to the final destination.

When to Use DDP vs CIF vs FOB in 2025?

1.When to Use DDP

You want no customs formalities, customs duties, or shipping operations.

You aim to eliminate hidden costs and simplify international transactions.

Best for e-commerce, small businesses, and companies seeking door-to-door service.

You need specialized shipping solutions to effectively manage international shipping challenges and optimize operational efficiency.

2.When to Use CIF

You prefer seller covers shipping and insurance to the destination port.

You can handle import customs clearance, customs fees, and delivery duty locally.

Suitable for businesses with local logistics partners.

Acknowledges the buyer’s responsibility for handling import customs clearance and local deliveries under CIF.

3.When to Use FOB

You have an experienced logistics team or freight forwarder.

You want control over the shipping process, including insurance coverage and freight costs.

You can manage import customs clearance and final delivery independently.

You prefer fob agreements for greater control over shipping terms and the ability to choose your own shipping options.

Optimize International Trade Transactions with the Right Incoterm

Choosing the right Incoterm in 2025—whether DDP, CIF, or FOB—is essential for optimizing shipping costs, ensuring smooth customs clearance, and managing your international supply chain efficiently.

For businesses new to international commerce, DDP offers the most convenience but at a higher cost. CIF provides a balance, while FOB is ideal for experienced importers seeking full control over the shipping process.

Collaborating with a trusted freight forwarder can help you navigate international shipping operations, comply with export and import requirements, and minimize expenses incurred during global trade transactions.

FAQ: DDP vs CIF vs FOB (2025)

Q1: Is DDP always more expensive than CIF and FOB?

A1: Generally, yes, as DDP covers the entire shipping process including customs duties, insurance costs, and final delivery, which leads to higher transportation costs. Under DDP, the seller’s responsibility extends to delivering goods to the final destination, unlike FOB, where the seller’s duty ends at the port of shipment.

Q2: Which Incoterm is best for small businesses in 2025?

A2: DDP is ideal for small businesses, as it removes the burden of customs clearance and complex international logistics.

Q3: Can FOB be used for air freight?

A3: Technically, FOB is mainly for sea freight, but in practice, some businesses use FOB-like arrangements for air freight with proper agreements.