When importing goods from overseas—especially from countries like China—it’s essential to understand the differences between Incoterms such as DDP (Delivered Duty Paid) and DAP (Delivered at Place). These two trade terms are commonly used in global logistics and define who is responsible for shipping, taxes, customs clearance, and delivery.

If you’re wondering whether DAP or DDP is better for your business or your Amazon FBA shipments, this guide will walk you through everything you need to know.

We’ll cover:

What DDP and DAP mean

Who takes on responsibility and cost in each case

When to choose one over the other

Real-world shipping scenarios from China to the USA, Germany, and UAE

And how to avoid common pitfalls

Let’s dive into the key distinctions between these two crucial Incoterms.

What Is DDP (Delivered Duty Paid)?

DDP stands for Delivered Duty Paid, meaning the seller takes full responsibility for getting the goods to the buyer’s final destination—including all shipping fees, import duties, customs clearance, and last-mile delivery.

When you choose DDP shipping, you’re essentially outsourcing the entire logistics chain to the seller or their freight forwarder. This includes:

Export procedures in the origin country

International shipping by air, sea, or rail

Import customs clearance in the destination country

Payment of import duties and VAT

Local delivery to your door, warehouse, or Amazon FBA center

Key advantages of DDP:

Zero customs hassle for the buyer

Predictable, all-in-one pricing

Ideal for first-time importers or eCommerce sellers

Example: If you’re shipping electronics from Shenzhen, China to an Amazon warehouse in the United States, a DDP shipment would cover the entire journey. The goods are delivered to your FBA location without any additional paperwork or payment from your side.

Best suited for:

- New importers unfamiliar with customs clearance

- Buyers seeking a turnkey shipping solution

- Amazon FBA sellers shipping from China

DDP is also useful in markets with complex import systems like the USA, UK, or European Union, where navigating customs can be time-consuming and expensive.

What Is DAP (Delivered at Place)?

DAP, or Delivered at Place, is an Incoterm where the seller delivers the goods to an agreed destination in the buyer’s country—but the buyer is responsible for import duties, VAT, and customs clearance.

Under DAP shipping, the seller covers:

Export clearance in the origin country

International transport to the agreed delivery point

However, the buyer must handle:

Import clearance

Duties and taxes

Final delivery (if not included)

Example: A business in the UAE imports industrial tools from China under DAP terms. The Chinese seller ships the goods to the Dubai port, but the UAE buyer must arrange customs clearance and pay import taxes before the cargo is released.

Why choose DAP?

You want control over local customs

You have tax exemption benefits or a local customs broker

You want to reduce seller markup on duties

DAP is popular for:

- B2B shipments where the buyer has import experience

- Large-volume imports

- Markets with low or flexible import duties

DAP is often preferred by experienced importers in countries like Russia, the UAE, or Brazil, where local customs can be negotiated or handled efficiently by in-house teams.

DDP vs DAP: Key Differences at a Glance

Choosing between DDP and DAP Incoterms starts with knowing where responsibility shifts from seller to buyer. Below is a simplified comparison table of DAP vs DDP shipping terms:

| Feature | DDP (Delivered Duty Paid) | DAP (Delivered at Place) |

|---|---|---|

| Customs Clearance | Seller handles all import formalities | Buyer is responsible |

| Import Duties & VAT | Paid by seller | Paid by buyer |

| Delivery Location | Final address (e.g. warehouse, home, FBA) | Agreed location (e.g. port, terminal) |

| Buyer Responsibility | None beyond payment | Duties, taxes, documentation |

| Risk Transfer Point | At final delivery point | Upon arrival at agreed destination |

| Cost Transparency | All-inclusive quote | Taxes/duties may vary upon arrival |

| Recommended For | E-commerce, new importers, FBA sellers | B2B buyers, experienced importers |

Tip: Use this table when comparing DDP vs DAP shipping from China to markets like the USA, EU, or the Middle East.

This visual breakdown helps importers quickly identify the best fit based on control, cost predictability, and customs involvement.

When to Use DDP or DAP?

Knowing when to choose DDP shipping vs DAP depends on your business needs, destination market, and logistics preferences. Here’s how to decide:

Choose DDP if:

You’re importing to countries with complex customs (e.g., USA, UK, Germany)

You want zero involvement with duties or taxes

You’re an eCommerce seller using Amazon FBA or similar warehouses

You prefer predictable, all-inclusive shipping costs

Choose DAP if:

- You have your own customs broker or freight handler

- Your company has tax exemptions or low-duty privileges

- You want to negotiate duties or manage paperwork directly

- You’re importing to countries where customs clearance is straightforward (e.g., UAE, Singapore)

Pro Tip: DDP is great for hassle-free delivery, but may come with a slightly higher cost. DAP gives you more control, especially if you have the resources to manage customs internally.

Still unsure? The next section walks through real-world DDP and DAP examples so you can see how they work in practice.

Real Examples: DDP vs DAP in Action (China to USA, Germany, UAE)

🇺🇸 Example 1 – DDP Shipping from China to the USA

A U.S.-based Amazon FBA seller purchases phone accessories from a supplier in Shenzhen. The supplier offers DDP air freight shipping.

Goods are picked up from the factory

All export documents are prepared by the seller

Import taxes and customs in the U.S. are paid in advance

Final delivery is made directly to the FBA warehouse in Los Angeles

Result: The buyer receives goods on time with zero customs involvement. Ideal for fast-moving consumer products.

🇩🇪 Example 2 – DDP from China to Germany

An eCommerce store in Berlin buys electric scooters from a Chinese manufacturer.

The seller ships via DDP rail freight (China-Europe train route)

Duties and VAT are included in the price

Final delivery is made to the warehouse with no paperwork from the buyer

Result: Time-efficient delivery across borders without the buyer dealing with EU customs.

🇦🇪 Example 3 – DAP Shipping from China to the UAE

A Dubai-based importer buys 3D printers from China under DAP Incoterms.

The goods arrive at Jebel Ali Port

The buyer receives a customs notice, pays import duty

Their local clearing agent finalizes customs paperwork

Buyer arranges last-mile delivery

Result: The buyer saves on shipping cost but takes full responsibility for customs.

These examples show how DDP vs DAP shipping from China varies depending on your market, product type, and import capacity.

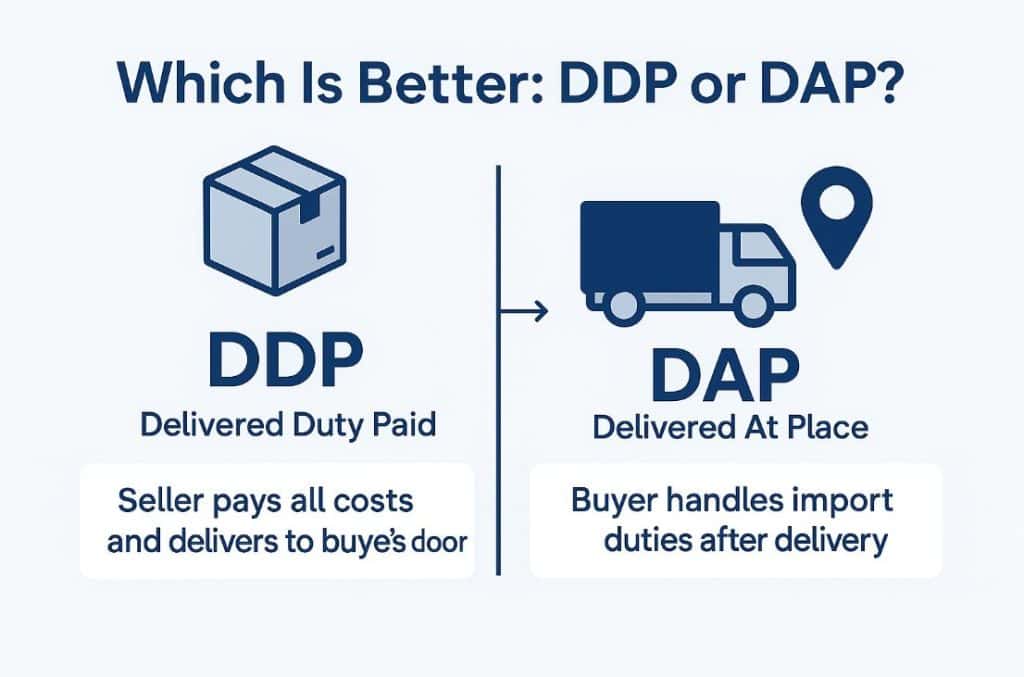

Which Is Better: DDP or DAP?

The choice between DDP and DAP shipping isn’t about which is universally better—it’s about which is better for your specific situation.

Choose DDP if you want:

Worry-free delivery from China to your door

No customs paperwork or unexpected import taxes

One price that includes everything

Choose DAP if you prefer:

- To handle customs clearance yourself

- To reduce costs by managing taxes or duties locally

- To have flexibility with your preferred forwarder or customs broker

Bottom line: DDP offers simplicity and peace of mind. DAP gives you control and can reduce landed costs—if you know what you’re doing.

Need help deciding? At Tonlexing, we offer both DDP and DAP shipping services from China to destinations like the USA, UAE, and EU. We’ll help you compare rates, paperwork, and transit time—so you pick the right Incoterm every time.

Contact us for a custom quote or advice on choosing between DDP vs DAP.

FAQs: DDP and DAP Explained

What does DDP mean in international shipping?

DDP (Delivered Duty Paid) means the seller takes full responsibility for shipping, import duties, customs clearance, and delivery to the final destination. The buyer pays nothing beyond the purchase price.

What does DAP mean in shipping terms?

DAP (Delivered at Place) means the seller delivers the goods to an agreed location, but the buyer handles import customs, taxes, and final delivery steps.

Is DDP better than DAP for Amazon FBA shipments?

Yes. DDP is highly recommended for Amazon FBA shipments, as it ensures goods arrive without customs delays or additional charges.

Who pays customs duties under DAP?

The buyer. Under DAP terms, the buyer must pay any import duties, VAT/GST, and handle all customs paperwork.

Can I use DDP when shipping from China to the USA?

Absolutely. DDP shipping from China to the USA is very common and widely used by eCommerce sellers and new importers.

Why do some sellers prefer DAP over DDP?

DAP gives sellers fewer responsibilities and shifts the risk and cost of import clearance to the buyer. It’s often cheaper for the seller.

Is DDP more expensive than DAP?

Yes, typically. DDP includes all taxes, duties, and clearance fees, so it costs more—but offers a more convenient experience for the buyer.

What happens if I choose DAP and fail to clear customs?

Your goods will be held at the port or terminal until you complete customs clearance. This may result in delays or storage charges.