Billionaire Li Ka-shing, one of Hong Kong’s most influential business magnates, has long been a dominant force in global infrastructure and logistics through his conglomerate CK Hutchison Holdings. However, his recent $22.8 billion sale of 43 ports worldwide marks one of the largest port transactions in history, reshaping global shipping, trade logistics, and port ownership structures.

This massive divestment involves strategic port assets spanning Asia, Europe, the Middle East, and the Americas, with significant implications for international trade, supply chain efficiency, and geopolitical power shifts. The buyer consortium, led by BlackRock and Global Infrastructure Partners, signals Western interests reclaiming control over key maritime gateways, particularly those linked to the Panama Canal and major trade routes.

Given the increasing politicization of global supply chains, this deal is more than just a business move—it is a major shift in trade power, infrastructure investment strategies, and global logistics management. The outcome of this sale will be watched closely by governments, multinational corporations, and global shipping alliances as they assess its long-term impact on international trade routes and port operations.

This high-stakes transaction raises critical questions:

- What does this sale mean for the future of global shipping and logistics?

- Who stands to benefit from this restructuring of port ownership?

- How will this impact freight costs, trade security, and supply chain reliability?

The following analysis will dive deeper into the ports involved, key buyers, financial impacts, and potential geopolitical consequences of Li Ka-shing’s landmark port sale.

Scope of the Sale

The $22.8 billion sale of Li Ka-shing’s 43-port portfolio spans key global trade hubs across Asia, Europe, the Americas, and the Middle East. The deal involves a majority 80% stake in Hutchison Ports, CK Hutchison’s port and terminal division, acquired by a consortium led by BlackRock, Global Infrastructure Partners, and Terminal Investment Limited.

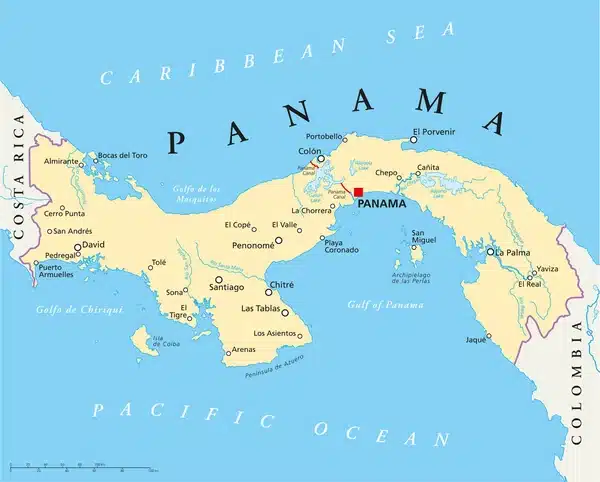

One of the most strategic assets in the sale is the Panama Ports Company, which operates two of the most critical ports at both ends of the Panama Canal:

- Balboa Port (Pacific side) – A key transshipment hub for cargo moving between the Pacific and Atlantic.

- Cristobal Port (Atlantic side) – Facilitates trade between North America, Latin America, and Europe.

The deal also includes major port terminals in Europe, such as those in the UK, Germany, Spain, and the Netherlands, as well as Asian and Middle Eastern terminals that are vital for handling global trade flows.

While the full list of 43 ports has not been publicly disclosed, CK Hutchison has an extensive presence in the following regions:

Key Ports Included in the Sale (Confirmed & Expected)

Americas

- Balboa Port (Panama) – Pacific gateway to the Panama Canal

- Cristobal Port (Panama) – Atlantic gateway to the Panama Canal

- Ensenada International Terminal (Mexico)

- Freeport Container Port (Bahamas)

Europe

- Felixstowe Port (UK) – One of the largest container ports in the UK

- Harwich International Port (UK)

- Barcelona Europe South Terminal (BEST, Spain)

- Gdynia Container Terminal (Poland)

- Terminal Burchardkai (Germany)

Asia & Middle East

- Kwai Tsing Container Terminal (Hong Kong)

- Dammam Container Terminal (Saudi Arabia)

- Karachi International Container Terminal (Pakistan)

Additional ports in Latin America, Southeast Asia, and the Middle East are expected to be part of the transaction, further strengthening BlackRock’s influence in global trade infrastructure.

This expansive network of ports is crucial for global supply chains, manufacturing exports, and transshipment operations, making this sale one of the most influential logistics transactions in modern history.

Strategic and Geopolitical Implications

Li Ka-shing’s $22.8 billion sale of 43 ports is more than just a financial transaction—it has significant strategic and geopolitical ramifications that could reshape global trade routes, supply chain security, and maritime dominance.

Geopolitical Dynamics: Rebalancing Global Port Ownership

One of the biggest political undercurrents of this sale is the shift of strategic port assets from Chinese-backed ownership to a U.S.-led investment consortium. Given rising concerns over China’s global infrastructure influence, particularly under the Belt and Road Initiative (BRI), the deal aligns with efforts to limit Beijing’s control over critical maritime gateways.

Panama Canal Influence – The sale includes a 90% stake in Panama Ports Company, which operates Balboa and Cristobal, two critical ports at both ends of the Panama Canal.

- The U.S. has long been wary of Chinese investments in Latin American infrastructure due to its proximity to key U.S. trade routes.

- Former U.S. President Donald Trump and policymakers have previously raised concerns about reducing Chinese influence in the region, making this sale a strategic shift towards Western control.

Europe’s Major Shipping Hubs – Some of the key ports in the UK, Germany, and Spain included in this deal play a vital role in Europe’s trade with Asia, North America, and Africa.

- European regulators are increasingly scrutinizing Chinese investments in ports and logistics, pushing for more Western-aligned ownership of key maritime assets.

Middle East & Asia’s Logistics Network – The sale also covers port assets in Saudi Arabia, Pakistan, and Hong Kong, potentially reducing Chinese-state-affiliated control over key supply chain hubs.

By shifting control of these global shipping hubs to a Western-led consortium, the deal reflects the broader push by the U.S. and its allies to curb China’s economic expansion in global trade infrastructure.

Operational Continuity: Changes in Port Management & Shipping Alliances

With BlackRock and its partners taking over 80% of Hutchison Ports, new management and investment strategies could lead to operational changes in global logistics.

Potential Operational Shifts:

- Revised Port Pricing Models – New ownership may introduce different port fees and service agreements, affecting global shipping costs.

- Changes in Cargo Prioritization – Certain trade routes and partner alliances may gain or lose priority based on new corporate interests.

- Increased Investment in Automation & Sustainability – As a U.S.-backed entity, the new owners may push for AI-driven port operations, emissions reduction, and green energy projects in line with Western climate policies.

Potential Trade Route Disruptions:

- The Panama Canal sale could alter shipping costs and trade dynamics for companies reliant on Asia-to-Americas transshipment.

- Ports in Europe under new management may see adjustments in handling Asian imports, potentially affecting container traffic from China.

Competitive Reactions: China’s Potential Response

This deal could trigger strategic countermeasures from China, which has heavily invested in port infrastructure worldwide under the Belt and Road Initiative (BRI).

- China’s Response in Latin America – China may strengthen port investments in Brazil, Argentina, and Ecuador to counterbalance its reduced influence in Panama.

- Alternative Trade Routes – Beijing may accelerate developing Arctic shipping routes, China-Europe rail freight corridors, or further investments in Africa’s ports.

- Push for More Asian Port Control – China may seek to increase its stakes in Southeast Asian and Indian Ocean ports, particularly in Malaysia, Sri Lanka, and Indonesia.

This sale is likely to trigger new port investment battles between Western and Chinese-backed companies, as both sides seek to secure control over the global supply chain.

Financial Impact: Strengthening CK Hutchison’s Capital Strategy

The $22.8 billion sale of 43 ports is a major financial restructuring for CK Hutchison, allowing the conglomerate to optimize its asset portfolio, reduce debt, and increase liquidity for future investments.

Cash Proceeds & Debt Reduction

- CK Hutchison will receive over $19 billion in cash after loan repayments and transaction-related expenses.

- This cash influx significantly improves the company’s balance sheet, reducing financial liabilities and enhancing investment flexibility.

Shift Towards Higher-Yield Investments

- By divesting port operations, CK Hutchison can redirect capital to higher-growth sectors, such as:

- Telecommunications & Digital Infrastructure – The company has expanded into 5G networks and broadband services in Asia and Europe.

- Real Estate & Urban Development – CK Hutchison owns a diverse portfolio of commercial and residential properties worldwide.

- Renewable Energy & Utilities – The conglomerate is investing in sustainable energy projects to align with global green initiatives.

Impact on Hutchison Ports’ Valuation & Shareholder Confidence

- Stock Market Reaction: CK Hutchison’s shares saw a 22% jump following the announcement, reflecting investor confidence in the deal’s long-term benefits.

- Dividend Potential: With increased cash reserves, CK Hutchison may return value to shareholders through dividends or stock buybacks.

- Improved Credit Ratings: Lower debt and higher liquidity could enhance the company’s credit rating, allowing better financing terms for future projects.

Conclusion: A Transformational Shift in Global Port Ownership

Li Ka-shing’s divestment of 43 ports marks one of the most significant shifts in global port ownership in recent history. This transaction is not merely a financial decision, but a strategic move with far-reaching implications for global trade, logistics, and geopolitical balance.

By transferring control of these critical shipping hubs to a U.S.-led investment consortium, the deal redefines global port management and reduces Chinese influence over key maritime assets. This transition aligns with broader Western efforts to reshape global supply chains, particularly around highly strategic trade corridors such as the Panama Canal and major European shipping hubs.

For CK Hutchison, this sale represents a calculated financial maneuver, enabling the company to strengthen its capital structure, reduce debt, and focus on higher-growth sectors such as telecommunications, infrastructure, and renewable energy.

However, the long-term impact on international trade, shipping costs, and port operations remains uncertain. With new ownership in place, the global shipping industry will closely monitor:

- Operational shifts in port management strategies

- Potential restructuring of trade alliances and shipping routes

- Future investment in port automation and infrastructure upgrades

Ultimately, this landmark deal signals a new era in global trade infrastructure, where business strategy, geopolitical interests, and supply chain security continue to intersect in complex and unpredictable ways. The world will now watch how BlackRock and its partners leverage these port assets and how China responds to the shift in global maritime control.