DAP vs DDP: Customs Clearance, Import Duties, and Who Pays What

- Verified & Reviewed · Last updated January 2026

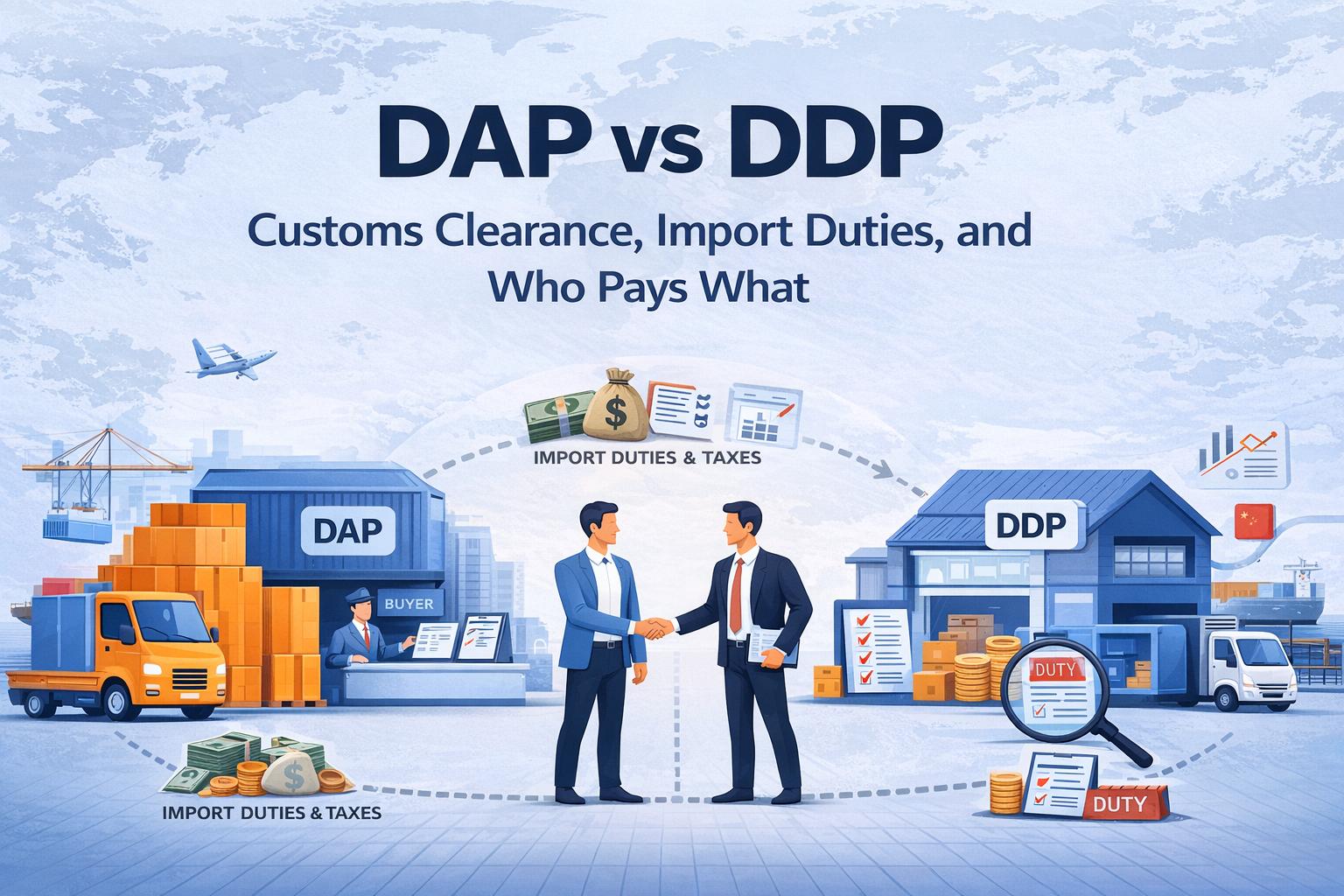

Choosing between DAP and DDP determines who handles import customs clearance, who pays import duties and taxes, and where cost risks may occur during international shipping.

This guide explains the practical differences between DAP and DDP under Incoterms® 2020 in clear, decision-focused language, helping importers and exporters choose the right term with confidence.

DAP vs DDP

Import Customs Clearance

Import Duties & Taxes

- Experienced China-based logistics specialists

Table of Contents

DAP vs DDP decision chart

Use this quick decision chart when quoting, negotiating, or choosing between DAP and DDP.

Choose DAP when

The buyer has a customs broker and understands customs clearance procedures

The buyer wants control over paying import duties and import taxes

The buyer’s country has strict importer rules that make it hard for the seller to act as importer

You want to reduce seller exposure to the import process and compliance risk

The buyer is responsible for a mature import program and can manage customs formalities efficiently

Choose DAP when

The buyer wants a simple process and a predictable landed cost

You ship to smaller importers, end customers, or e commerce buyers

You can support compliant import customs clearance in the destination country

You want fewer delivery surprises at the final destination

You offer ddp shipping services and have proven partners to manage duties and taxes

If you are not sure

Start with DAP and offer an option to upgrade to DDP after confirming compliance, duty estimation, and importer structure. This reduces disputes and protects both seller and buyer.

DAP vs DDP comparison table

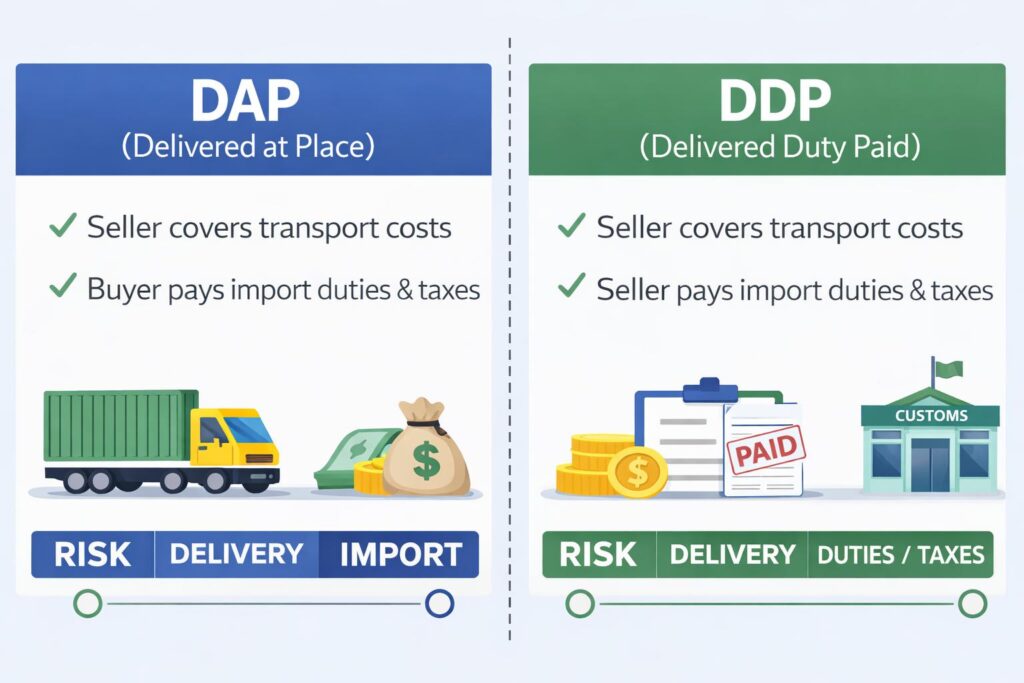

| Topic | DAP Delivered at Place | DDP Delivered Duty Paid |

|---|---|---|

| Import clearance | Buyer handles import clearance | Seller is responsible for import clearance |

| Customs clearance | Buyer manages customs clearance procedures | Seller handles customs clearance procedures |

| Import duties and import taxes | Buyer pays import duties and import taxes | Seller pays import duties and import taxes |

| Export clearance | Seller usually completes export clearance | Seller usually completes export clearance |

| Risk transfers | When goods arrive ready for unloading | After import customs clearance, at delivery |

| Best for | Buyers with broker and import capability | Buyers who want predictable landed costs |

| Typical issue | Buyer delays create storage costs | Seller faces compliance and duty risk |

| Practical note | Works well for B2B importers | Works well for door to door and e commerce |

What DAP Delivered at Place means

DAP Delivered at Place means the seller delivers goods to the named delivery location in the destination country, ready for unloading. The delivery location can be the buyer’s premises, the buyer’s location at a warehouse, a port gate, or any agreed place.

With dap shipping, the seller often arranges main transport and export clearance. Once the goods arrive and are available for unloading, risk transfers to the buyer. After that moment, the buyer handles import clearance and import customs clearance.

Seller’s responsibilities under DAP

Seller’s responsibilities commonly include:

Export clearance and origin customs formalities

Main transport booking and coordination

Transportation costs and shipping related expenses to the delivery location

Seller delivers goods to the named place at the final destination, ready for unloading

Providing correct documents that support import procedures

In simple terms, the seller delivers to the place, but the buyer clears the border.

Buyer’s responsibilities under DAP

Under DAP, buyer assumes responsibility for:

Import clearance process and import formalities

Import customs clearance and handling customs clearance with a customs broker

Paying import duties, customs duties, duties and taxes, and import fees

Any storage, inspection, or local charges caused by delays

Compliance steps required in the destination country

This is why DAP is popular when the buyer has experience and wants control.

What DDP Delivered Duty Paid means

DDP Delivered Duty Paid means the seller takes maximum responsibility up to delivery at the buyer’s location. Many companies label it as ddp delivered duty paid, or ddp delivered duty paid on invoices to avoid confusion.

Under delivered duty paid, the seller is responsible for import customs clearance and for paying import duties and import taxes in the destination country. The buyer typically receives the cargo and manages unloading.

In practice, ddp shipping services require careful structure. Some countries restrict who can act as importer. If the seller cannot legally import, DDP may need an alternative structure, or the deal should move to DAP.

Seller’s responsibilities under DDP

Seller’s responsibilities under DDP often include:

Export clearance

Main transport, destination handling, and the delivery process to the final destination

Import clearance and customs clearance procedures

Paying import duties, import duties taxes, and import taxes

Paying import fees and customs fees required for release

Managing associated costs tied to customs procedures

DDP means the seller bears more financial responsibility and more operational responsibility.

Buyer’s responsibilities under DDP

Even with duty paid ddp, the buyer still needs to:

Provide accurate consignee and delivery location information

Be available for delivery appointments and the unloading process

Support compliance questions if products require extra documents

Avoid actions that create redelivery or extra handling charges

DDP reduces buyer’s involvement, but it does not eliminate cooperation.

Customs clearance and import clearance responsibilities

This section targets the highest intent searches around customs clearance, import customs clearance, import clearance, and handling customs clearance.a

Under DAP

The buyer handles import clearance

The buyer manages import customs clearance and customs formalities

A customs broker usually completes the import clearance process

The buyer pays import duties and import taxes as part of the import process

If the buyer is not prepared, the shipment can be held, causing customs fees, storage, and unexpected costs.

Under DDP

The seller is responsible for import clearance

The seller handles customs clearance procedures and import procedures

The seller pays duty charges, import fees, and duties and taxes

The seller manages the import process and bears most related delays

DDP is simpler for the buyer, but it is heavier on the seller. DDP works best when the seller has reliable partners in the destination country.

Import duties, import taxes, import fees, and associated costs

Import duties and import taxes drive most landed cost differences between dap and ddp. Import duties taxes may change based on HS code, declared value, and product restrictions.

Under DAP

The buyer pays import duties and import taxes. The buyer should confirm:

HS code and valuation method in the buyer’s country

Payment process for paying import duties

Import clearance process timing and documents

Local import procedures and any product approvals

Because the buyer pays, the buyer assumes responsibility for duty accuracy. A broker can help, but the buyer is responsible for final compliance.

Under DDP

The seller pays import duties and import taxes. The seller should prepare:

A duty estimate method and a buffer for changes

A clear scope of what is included, especially customs duties and import fees

A plan for inspections and document corrections

A control process to avoid compliance mistakes

Unexpected costs to watch

Unexpected costs often appear during customs clearance procedures:

Storage and demurrage at terminal

Inspection fees and extra handling

Document correction fees

Re classification and value adjustments

Redelivery and appointment costs at the buyer’s premises

To reduce unexpected costs, define who pays them in sales contracts.

Shipping costs and transportation costs breakdown

Shipping costs and transportation costs include more than the freight itself.

Under DAP

Seller bears main shipping costs to the named place

Buyer pays import side charges such as customs duties and import fees

Buyer pays duties and taxes after arrival

Buyer bears costs caused by delayed import clearance

Under DDP

Seller bears shipping costs plus import side costs

Seller pays import duties taxes and import fees

Seller bears more associated costs during customs procedures

Cost breakdown template

You can use this list on quote pages to explain the shipping process:

Origin charges and export clearance

Main freight and shipping fees

Destination handling charges

Customs broker fee and handling customs clearance

Import duties and import taxes

Final delivery to the buyer’s location

Risk transfers and risk management

Risk transfers defines when the risk moves from seller to buyer. Risk transfers is a key differences topic in ddp and dap disputes.

Risk transfers under DAP

Risk transfers when goods arrive at the delivery location ready for unloading. Once risk transfers, buyer’s risk includes delays related to customs clearance and the import clearance process.

Risk transfers under DDP

Risk transfers after import clearance is completed and the goods are delivered to the final destination ready for unloading. This reduces buyer’s risk during the border stage.

Practical risk management tips

Confirm document accuracy before departure

Set a deadline for document approval

Agree who pays storage if customs holds the shipment

Decide how to handle inspections and extra handling

Use a responsibility checklist to avoid confusion

International shipping process step by step

Many readers search for the international shipping process because they want a clear flow. This section improves time on page and helps rank for international shipping process and global shipping.

Step 1: Sales contract and Incoterm selection

Set the Incoterm and name the delivery location. Decide whether it is DAP or DDP, then define the final destination clearly.

Step 2: Export clearance and origin preparation

The seller usually completes export clearance. The seller delivers documents, confirms packing lists, and prepares the shipment for departure.

Step 3: Main transport and freight forwarders

The seller arranges transport through freight forwarders. Freight forwarders coordinate booking, loading, and tracking.

Step 4: Arrival and destination handling

After arrival, the shipment enters destination handling. This stage can create shipping related expenses if the cargo waits too long.

Step 5: Customs clearance and import clearance process

This stage is the most sensitive. Customs clearance procedures and customs formalities determine whether goods move quickly or get held.

Under DAP, buyer handles import clearance.

Under DDP, seller is responsible for import clearance.

Step 6: Delivery to the named place

After customs release, delivery continues to the buyer’s location. The delivery process ends when the goods arrive ready for unloading.

How freight forwarders handle DAP and DDP

Freight forwarders play a major role in the shipping process, but their scope depends on what the buyer and seller agree.

DAP with freight forwarders

In dap shipping, freight forwarders often manage transport and destination delivery, while the buyer’s broker manages import customs clearance. This split requires strong coordination.

DDP with freight forwarders

In ddp shipping, freight forwarders may coordinate the entire chain including handling customs clearance and final delivery. This often feels smoother for buyers because one party manages more steps.

Quote clarity that improves conversion

Ask freight forwarders to separate:

Transportation costs and shipping fees

Customs broker and handling customs clearance fees

Import duties taxes and import taxes

Local delivery and appointment fees

This reduces confusion about all the costs and financial responsibility.

How to write DAP and DDP correctly in sales contracts

Most disputes come from vague wording. A strong contract uses clear terms and a precise named place.

Write the named place clearly

Use a complete delivery location with city and address when possible. This reduces disagreements about the final destination.

Define who pays what

Even if DDP is used, specify what is included:

Duties and taxes included or excluded

Customs fees included or excluded

Storage and inspection handling

Appointment and redelivery handling

Add a simple delay clause

If customs selects the shipment for inspection, specify whether the seller bears those costs or whether they are shared. This prevents arguments and reduces unexpected costs.

Copy and paste responsibility checklist

DAP checklist

Seller’s responsibilities

Export clearance completed

Seller arranges transport and delivery to the delivery location

Seller delivers goods ready for unloading

Seller provides correct shipping documents

Buyer’s responsibilities

Buyer handles import clearance

Buyer handles import customs clearance and customs formalities

Buyer pays import duties and import taxes

Buyer manages customs broker

Buyer assumes responsibility after risk transfers

DDP checklist

Seller’s responsibilities

Export clearance completed

Seller arranges transport, destination handling, and delivery process

Seller is responsible for import customs clearance

Seller pays duty charges, import duties taxes, and import taxes

Seller bears most associated costs until delivery

Buyer’s responsibilities

Provide accurate delivery location and contact

Receive goods at the final destination

Manage unloading process

Common mistakes that increase unexpected costs

Mistake 1: unclear delivery location

A vague named place leads to disputes at the final destination. Always define the delivery location.

Mistake 2: assuming DDP is always possible

In some destination country markets, the seller cannot easily complete import formalities. Confirm structure before offering ddp delivered duty paid.

Mistake 3: ignoring customs delays

Customs clearance procedures can trigger inspections. Decide who pays storage, inspection fees, and extra handling.

Mistake 4: mixing responsibility

If both parties assume the other side is handling customs, the shipment stalls. Use checklists to keep the import process clear.

Use cases by business model and shipping mode

This section helps you outrank competitors by covering more search intent.

DAP vs DDP for e commerce buyers

DDP often improves the buyer experience because buyers do not face surprise duty payments at delivery. This can reduce refusals and improve conversion.

DAP can still work if the buyer is an experienced importer and wants control over paying import duties.

DAP vs DDP for B2B international trade

B2B importers often prefer DAP because they already have a customs broker and can handle import clearance procedures. They may also want to manage duties and taxes for accounting reasons.

DAP vs DDP for air freight

Air freight is fast, but customs can still cause delays. DDP can reduce buyer’s involvement. DAP can be cost effective when the buyer can clear quickly.

DAP vs DDP for ocean freight

Ocean freight involves more terminal time, so customs delays can be expensive. If the buyer delays import clearance, storage and demurrage can rise. In these cases, clarity on customs formalities and financial responsibility is critical.

Frequently Asked Questions

DAP means the buyer handles import clearance and pays import duties and import taxes. DDP means the seller is responsible for import clearance and paying import duties and taxes.

Under DAP, the buyer handles customs clearance and works with a customs broker in the destination country.

In most cases, the seller arranges main transport to the delivery location, while the buyer pays import duties, import taxes, and import fees.

DDP is commonly used as door to door because the seller handles import clearance and duty payment up to the buyer’s location.

Risk transfers under DAP at delivery ready for unloading. Risk transfers under DDP after import customs clearance at the final destination.

Related Incoterms & DDP Shipping Guides

Get a DAP or DDP Shipping Quote from China

Compare DAP vs DDP landed cost before you ship

Clear breakdown: freight, clearance, duties & taxes

China-based team for door-to-door options

Send your cargo details and destination — we’ll quote both options and recommend the right term.